OMERS earns $3.1 billion in the first six months of 2025

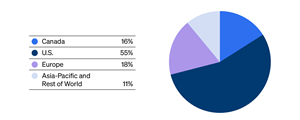

TORONTO, Aug. 21, 2025 (GLOBE NEWSWIRE) -- OMERS generated a net investment return of 2.2%, a gain of $3.1 billion, for the period of January 1 to June 30, 2025. This result brings the cumulative 10-year net investment income figure to $70.2 billion. Net assets at June 30, 2025 totalled $140.7 billion.

“OMERS had a positive start in what was a particularly challenging environment for investors,” said Blake Hutcheson, OMERS President and CEO. “As we manage through the current short-term challenges, in both public and private investing businesses this team continues to unlock opportunities that deliver both immediate and long-term value. Over the five years that we have reported our mid-year investment update, our talented global team and investment strategies have delivered an average annual net return of 8.7%.”

“Six of our seven asset classes delivered positive results in the first half of 2025. Infrastructure and public equities drove returns, supported by credit and bonds,” said Jonathan Simmons, OMERS Chief Financial and Strategy Officer. “Currency had an overall negative 1.2% impact on our results, driven by a significant decline in the U.S. dollar, and partially offset by strengthening of the British pound sterling and euro. Active decisions to hedge currencies added almost 1% to returns, protecting portfolio value. Private investment valuations and transaction activity, particularly in private equities and real estate, continue to be held back by uncertainty in the global marketplace.”

“While we expect continued market instability for the remainder of 2025, we believe our diversification in quality assets positions us well to see through this cycle, with ample liquidity to pursue opportunities that meet our objective of paying pensions for generations to come,” said Mr. Hutcheson. “We proudly serve 640,000 Ontarians and we work every day to build lasting value that will serve them throughout their retirement.”

About OMERS

OMERS is a jointly sponsored, defined benefit pension plan, with more than 1,000 participating employers ranging from large cities to local agencies, and 640,000 active, deferred and retired members. Our members include union and non-union employees of municipalities, school boards, local boards, transit systems, electrical utilities, emergency services and children’s aid societies across Ontario. OMERS teams work in Toronto, London, New York, Amsterdam, Luxembourg, Singapore, Sydney and other major cities across North America and Europe – serving members and employers, and originating and managing a diversified portfolio of high-quality investments in government bonds, public and private credit, public and private equities, infrastructure and real estate.

Media Contact

Don Peat

Director, Media Relations

1 416.417.7385

dpeat@omers.com

Net Assets

$ Billions

Net Return History

to June 30, 2025

| 6-month (January 1, 2025 – June 30, 2025) 2.2%, a gain of $3.1 billion |

|

| 10-year (July 1, 2015 – June 30, 2025) 6.9%, a gain of $70.2 billion |

|

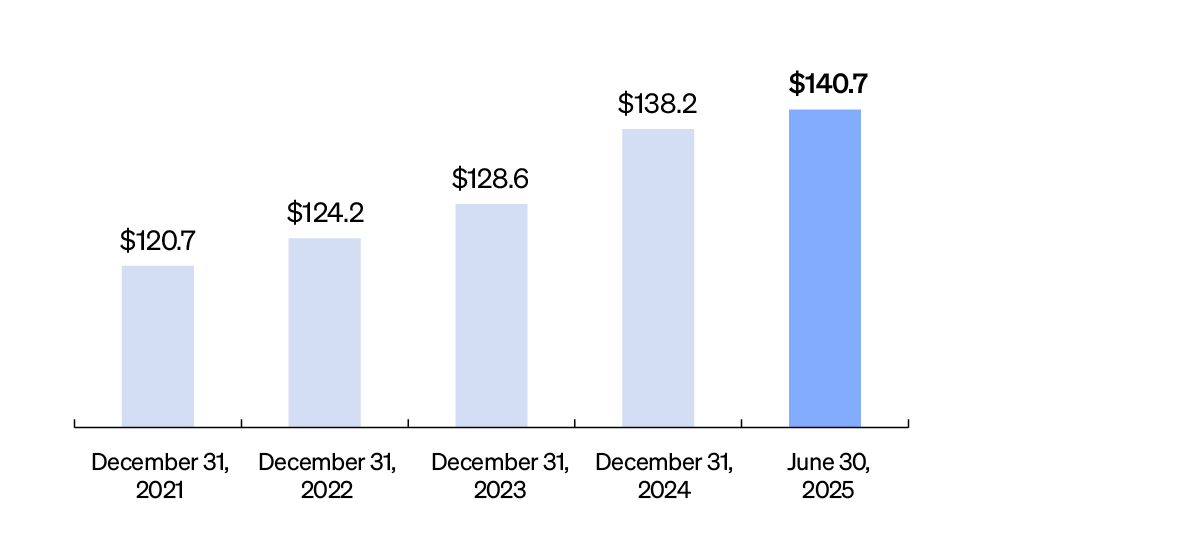

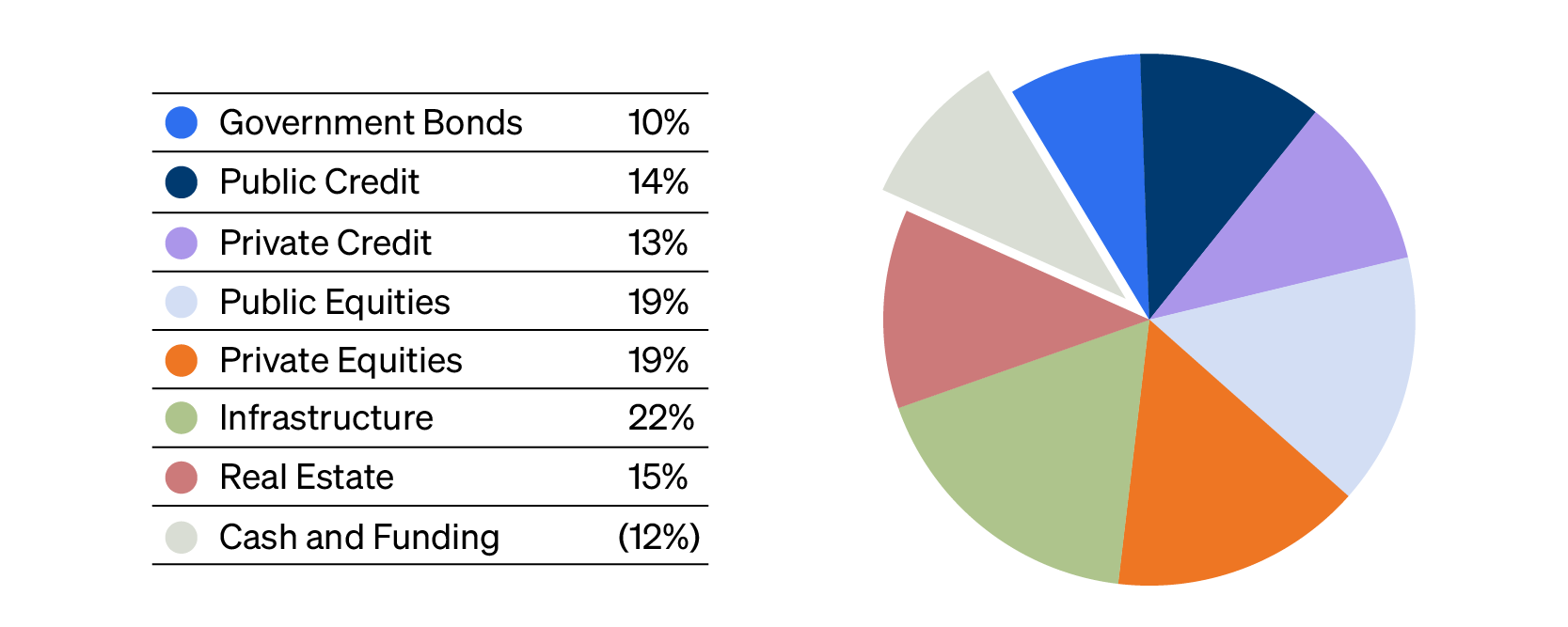

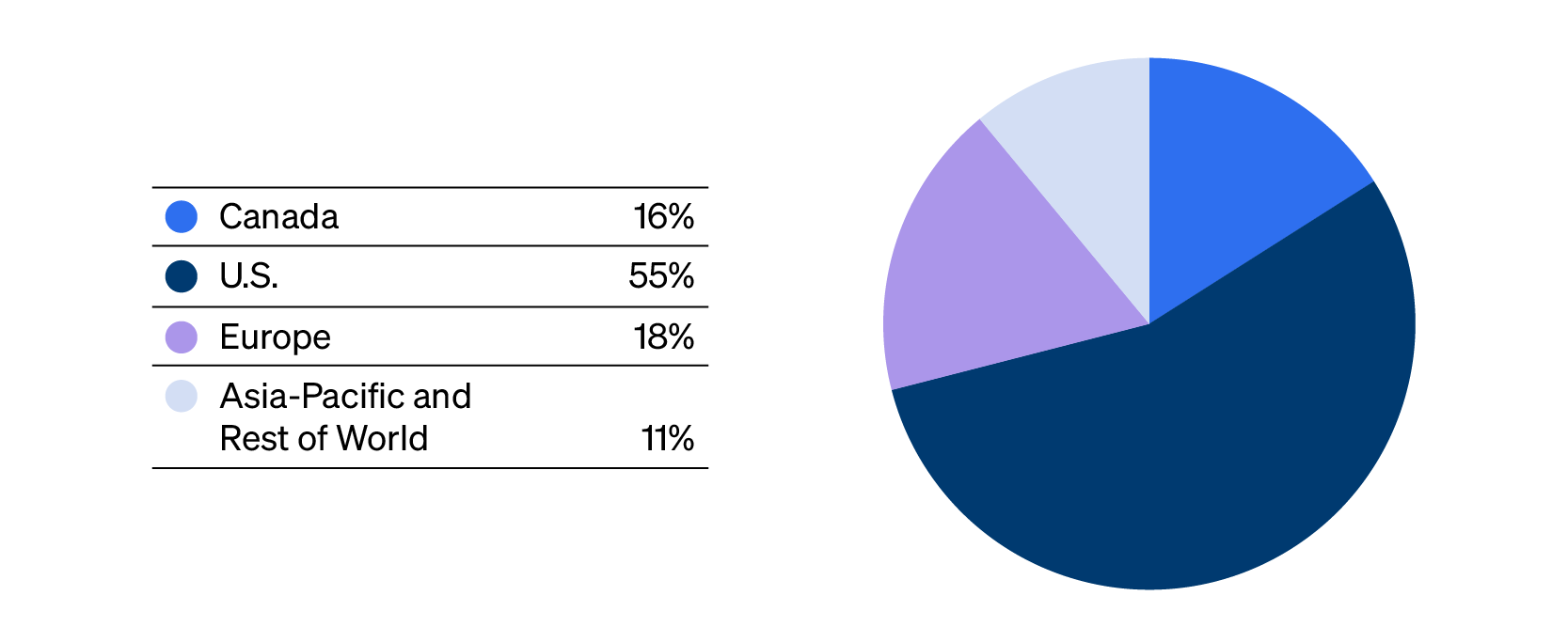

Diversified by Asset Class and Geography

OMERS invests in high-quality assets that are well-diversified by geography and asset type.

Asset Diversification

As at June 30, 2025

Geographic Diversification

As at June 30, 2025

Asset Class Investment Performance

| Net Returns | |||

| Six months ended June 30, 2025 |

|||

| Government Bonds | 2.1 | % | |

| Public Credit | 1.6 | % | |

| Private Credit | 2.7 | % | |

| Public Equities | 2.4 | % | |

| Private Equities | (1.3 | %) | |

| Infrastructure | 3.6 | % | |

| Real Estate | 1.1 | % | |

| Total Plan | 2.2 | % | |

Investment Performance Highlights

Over the six months ended June 30, 2025:

- The more than 5% decline in the U.S. dollar in the first half of the year meaningfully detracted from our returns across asset classes, particularly in public and private equity. Our active decisions to hedge our currency exposure added almost 1% to the portfolio, including an approximate 30-basis point lift from our increase to U.S. dollar hedges at the end of 2024. This currency management strategy, combined with our diversification in the British pound sterling and euro, mitigated the otherwise negative impact on the portfolio.

- Our strategic focus to deploy into fixed income assets continued to positively contribute to our returns. Government bonds, public and private credit each delivered positive performance primarily due to interest income and a decline in bond yields.

- Public equities delivered positive performance from core large-cap holdings in financials, communications services and information technology sectors.

- Private equities were held back as investor confidence remains challenged and markets continue to exhibit very low levels of activity. As a result, valuations continue to be impacted by slow earnings growth and headwinds within certain industry sectors.

- Infrastructure continues to deliver steady results, with most assets performing in line with expectations.

- Real estate delivered a positive return after a series of challenging years for the industry. Despite market uncertainty, results were supported by strong operating fundamentals, particularly in office and hotels.

Liquidity

We continue to maintain ample liquidity, with $17.4 billion in liquid assets to pay pension benefits, fund investment opportunities, satisfy potential collateral demands related to our use of derivatives, and to fund expenses.

Long-Term Issuer Credit Ratings

This Investment Update presents certain non-GAAP measures. These measures are calculated on the same basis as those calculated and presented in our 2024 Annual Report. This Investment Update and the Condensed Interim Consolidated Financial Statements (the “Interim Financial Statements”) are unaudited. OMERS Administration Corporation’s financial performance set out in this Investment Update is only for the period ended June 30, 2025, unless otherwise indicated. Past performance may not indicate future performance because a broad range of uncertainties (including without limitation those related to interest rates and inflation) could have an impact on the performance of various asset classes. The financial information included in this Investment Update should be read in conjunction with the Interim Financial Statements.

Portfolio update

We continue to invest in assets that build strong futures for communities and members alike.

Below is a selection of activities undertaken since January 1, 2025.

- We acquired full ownership of a high-quality office portfolio in Western Canada that includes seven office properties in Calgary’s and Vancouver's central business districts, totalling 4 million square feet. This portfolio is 95% occupied.

- We broke ground on 70 Hudson Yards, the first 1 million plus square foot, ground-up office development in New York City in over five years.

- We sold a 9.995% stake in Transgrid, the largest electricity transmission network in Australia, to Australian sovereign wealth fund, Future Fund. As part of this transaction, OMERS will manage that interest on their behalf in addition to our own 9.995% stake.

- We announced a transformative co-investment of over $200 million to retrofit the existing office buildings at Canada Square in midtown Toronto. The redevelopment will deliver 680,000 square feet of highly functional and modernized office space.

- Our shopping mall investments were recognized as national and regional market leaders in sales performance by the International Council of Shopping Centers. Yorkdale continues to dominate as Canada’s top-performing shopping centre for the second year running with ~$2,300 in sales per square foot. Square One Shopping Centre and Scarborough Town Centre also increased their sales per square foot.

- We officially opened the doors to the $1.3 billion Parkline Place, celebrating the opening of this new commercial office and retail destination in Sydney, Australia co-owned by Oxford Properties, and which includes the first new office tower in Sydney’s Midtown in almost a decade.

- We announced a joint partnership with AustralianSuper that aims to build a significant industrial and logistics venture across Europe. As part of this joint venture, we announced the acquisition of Broadheath Network Centre in Greater Manchester.

- OMERS Finance Trust (OFT) successfully closed two significant note offerings, a EUR 1 billion, 10-year note and a USD 1 billion, 5-year note. This marks OFT’s third EUR and ninth USD offering.

Subsequent to the end of June:

- We broke ground on the first major purpose-built housing project in Scarborough in over a generation on the west side of Oxford’s Scarborough Town Centre shopping mall. The development will consist of three residential towers of 1300 units with the aim of delivering critically needed housing in a historically undersupplied area for people at a variety of different price points, including a 21% allocation for affordable housing.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/46e209cb-a225-4871-a3df-5d64c05da1ea

https://www.globenewswire.com/NewsRoom/AttachmentNg/0f72a2a3-fbbb-4d13-9447-fac63c1ec46c

https://www.globenewswire.com/NewsRoom/AttachmentNg/9e5b3c88-afd8-4d42-8ff1-f76bbf161893

https://www.globenewswire.com/NewsRoom/AttachmentNg/5992d028-0759-42bb-b24b-6506db33ab42

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.